With united india car insurance being one of the oldest insurers in india having been set up in 1938 listed below are some of the key benefits of availing a car insurance policy from united india car insurance.

Yearly car insurance cost in india.

Car insurance is a contract between a car owner and an insurance company wherein the insurance company promises to protect the car owner from financial losses relating to his her car arising due to a misfortunate event like a road accident theft fire natural calamities man made calamities vandalism etc.

With the help of the car insurance calculator customers can get a quote for their car insurance policy and the premium amount they need to pay for.

How to choose the best car insurance company in india.

Almost every reputed motor insurance company has an insurance premium calculator on their official portal.

What is car insurance premium calculator.

Browse united india car insurance plans now.

These include your driving record credit history and coverage limits as.

United india car insurance has a claim settlement ratio of about 91 72 its policies also offer discounts to companies that install anti theft devices on their cars.

Here are some of the reasons to buy new car insurance policy in india.

Importance of car insurance in india.

Buying a car insurance policy is mandatory in india as per the motor vehicle act 1988.

Car insurance companies compensate for the loss or damage caused to the insured vehicle and a third party from the insured four wheeler.

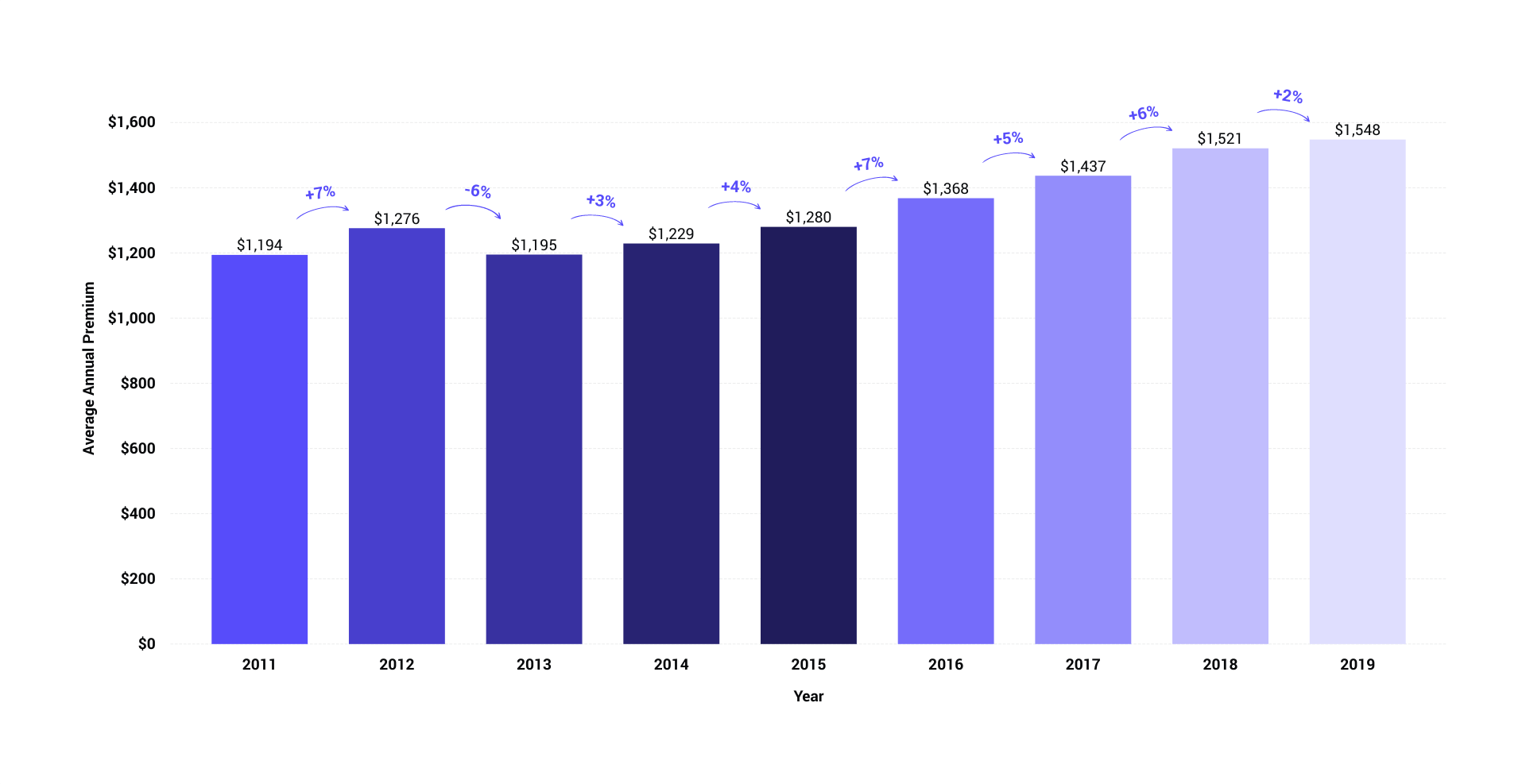

This is thanks to the increase in insurance cost over the past year.

That s the short answer.

Car insurance calculator provides customers with lots of variation in terms of premium rates as per their requirements.

The insurance regulatory and development authority of india has introduced two new sets of rules where the total outflow towards insurance has gone up sample this.

In fy 2017 2018 united india car insurance earned a net premium of rs 5 748 32 crore with an incurred claim ratio of 91 72.

The first year insurance cost for a car of capacity of over 1500 cc say a hyundai creta has gone up from.

Let s say you own a 1 year old standard hatchback with an insured declared value idv of rs.

A car insurance policy protects you from unexpected and unlikely events.

Here are some scenarios where a four wheeler insurance can act as a lifesaver.

Owning a car or bike has become costlier than before.

For calculating the exact car insurance premium a customer needs to mention the specific details that include date of registration car details policy start date and other extra coverage details.

The long answer is that the average cost depends on a variety of key factors many of which we ve outlined in the sections below.

The average annual cost of car insurance in the united states is 1 416 according to the data in our study.